If you’re an accountant, this must seem like a no-brainer. But for the rest of us, understanding your actual Total Manufacturing Costs (TMC) is as important as getting the product design right from the start.

TMC is the totality of all you spend on manufacturing operations. It goes beyond manufacturing overhead, materials, and labor costs. How many manufacturing teams consider all spending on what they produce and sell to clients? It takes a total view of your manufacturing operations to come up with an accurate representation of your cost.

Even inconsequential expenses should be included because, all together, these costs add up to your TMC. Knowing your TMC empowers you to make smart business decisions about where, when, and how to focus your time, money, and, more importantly, your effort. It also helps your departments budget for future projects to lower costs.

What Is TMC, And How Do You Calculate It?

Calculate total manufacturing cost is expressed as:

Total manufacturing costs = Direct materials + Direct labor + Manufacturing overhead

The key to calculating your TMC is to capture each of the costs in the above equation accurately. Let’s look at a few examples.

Direct Materials

These are the costs associated with all costs of raw materials used directly to manufacture your product. Direct material costs include the core components of your product, regardless of size, function, etc. Every bolt, every nut, etc., counts as direct materials needed to produce.

Direct Labor

The physical process of creating a product includes all the labor needed to take all raw resources and turn them into a product for sale. Think about the wages paid to everyone on the manufacturing team, including supervisors and management, engineers, technicians, machine operators, assemblers, and others who keep the manufacturing process running smoothly. Don’t forget to include the cost of any bonuses paid and even the taxes paid by your company related to direct labor.

Manufacturing Overhead

Your overhead includes the cost of the company’s other business operations and expenses you incur to operate and produce your goods. Your overhead is the sum of all other expenses, whether production costs or cost of goods sold (COGS), which allow you to operate and produce your products. For example, just like you pay utilities to run your home, a company has utility costs. It pays energy bills or the cost of renting or financing the plant itself, just like any other business. Maintenance contracts are necessary to create products, etc.

Finally, consider any costs incurred if your machinery breaks down or any depreciation costs associated with aging. These losses should be included as indirect costs that can’t be included in your manufacturing overhead cost.

What’s The Difference Between Direct And Indirect Manufacturing Costs?

Direct costs are more fluid than indirect costs in that they can change depending on how many products you’re creating if you’re scaling production up or down. Indirect costs like operating expenses include are more fixed, such as the utilities and other overhead you pay. These indirect costs are fixed in advance, like the abovementioned overhead cost.

These indirect costs aren’t part of the finished product itself but indirectly helped you produce. For example, special cleaning products, a certain type of glue, filtered water, and just about anything else can’t be found in your product, even if you listed its materials. However, they were still indirectly important to the process.

Indirect labor costs could include a cleaning crew, a maintenance team, and others who aren’t physically involved in manufacturing your product. But indirectly support the process.

Why Are Total Manufacturing Costs Important?

Understanding the total expenses of manufacturing your goods gives you options to reduce or eliminate some expenses that aren’t needed. For example, you may find a line item expense that’s completely outdated or never used that you could cut. Or you may search for a lower-priced energy provider to reduce overhead costs.

Calculating your TMC helps you see exactly where all the money is going, which gives you more clarity about your business’s financial health. Companies without an accurate picture of their TMC may make poor budgeting decisions and make it harder to predict profitability and manage business performance accurately.

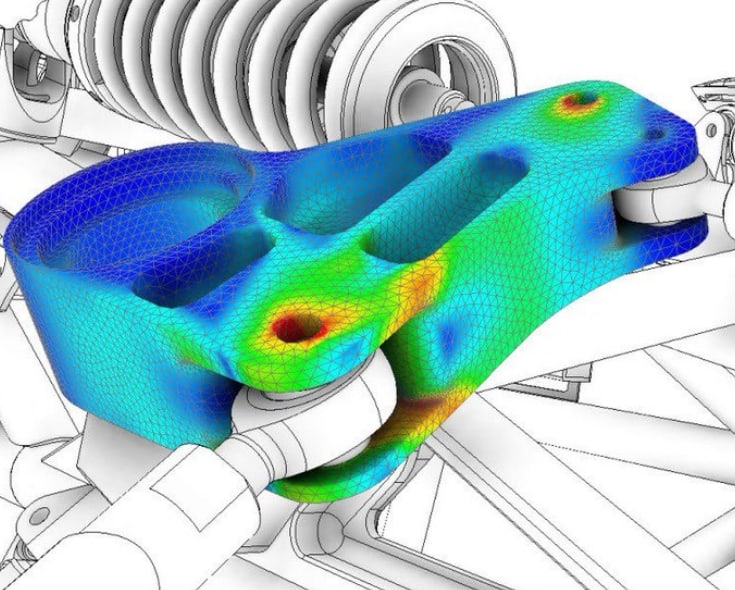

one area where knowing what the TMC helps when it’s time to make upgrades and improvements to the production process. Knowing the true manufacturing cost (TMC) of the product is invaluable to the engineering team when making upgrades and improvements to production. For example, 70% of product cost is determined by product design. The design team needs to know how much each component in a design adds to production costs. Not knowing the TMC means it’s hard for them to get it right.

Benefits Of Knowing Your TMC

Beyond the clarity you get of your company’s financial picture, here are a few benefits that make knowing your TMC a pressing concern.

- Better pricing. Knowing the full cost of your manufacturing process helps you make better product pricing decisions. If, after calculating TMC, you discover your costs are as low as possible, but your revenues are not where you want them, you may need to tweak your sales and marketing strategy.

- Or you may conclude you need to raise prices. Based on the investment you have into producing each product and your current market, you have a more accurate view of where your pricing should be.

- Less waste. Your TMC calculation also lets you look at what you’re paying for, both direct and indirect costs, and find places where you could reduce materials or inventory. Perhaps you have too must waste at the end of a production line. Knowing the cost of that waste helps you find a better, more eco-friendly way to manufacture your goods.

- Better business insight. You can more easily identify areas for improvement and drive efficiency when you analyze and understand your TMC. Perhaps your manufacturing and assembly processes have too many steps or unnecessary parts. A trusted engineering advisor can show you how to design efficiency into your process and reduce costs.

Final Thoughts

Get a thorough account of your TMC by tracking accurate cost data, even the seemingly small expenses. Once you know your TMC, you’re better prepared to make the hard decisions to change when needed. And tracking your actual costs gives you insight into how more cost-effective machinery or technology could provide you with a much greater return on investment than what you’re currently seeing.

Contact Pure Prime Solutions today if you’d like help to capture your total manufacturing cost. Our team of highly educated and experienced engineers can help you figure out how to capture the right data. Then we use that information to find innovative, high-tech solutions that drive down your total manufacturing costs and generate a substantial return on investment.